Maximize your value. Protect your future.

Running a business takes all you have. We know because we’ve been there, building our own business while also guiding countless owners through the same journey. It becomes more than a job, it’s part of who you are. For many, selling the business is the key to their future. But too often, owners wait too long to plan their exit, and when the time comes, they’re caught off guard.

At Highland Trust Partners, we help small and midsize business owners take control of the exit process. Whether you plan to sell, transition to a family member, or just want to know your options, we’ll help you protect what you’ve built and create a clear path forward.

Book a 30-minute intro call to see what your business is worth.

Why Succession Planning Matters

You may not be planning to exit your business tomorrow. But here’s the truth:

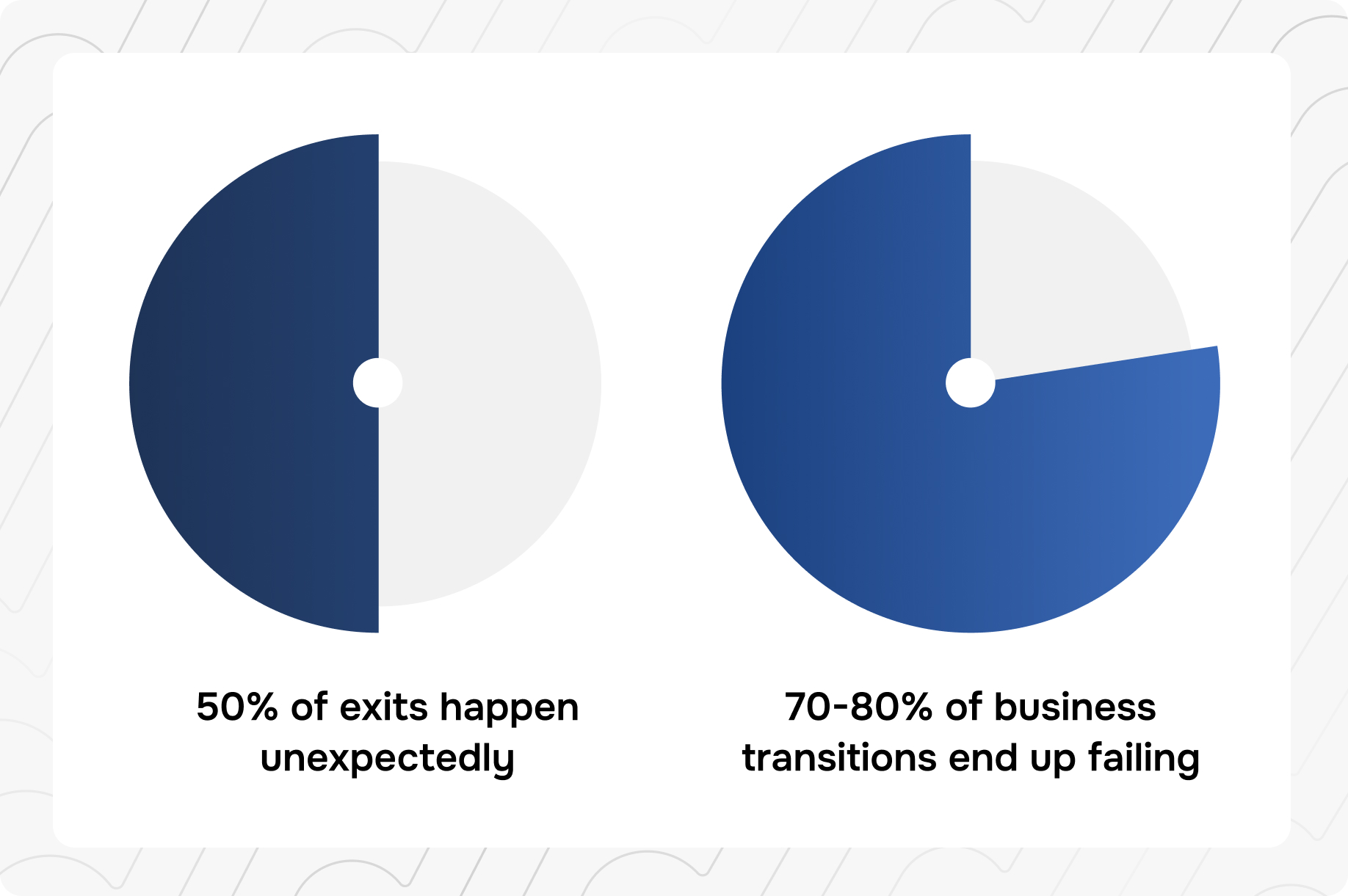

- 70–80% of business transitions fail nationally

- 50% of exits are involuntary, triggered by illness, burnout, or family changes

- 98% of owners don’t know the value of their business

That means most owners leave money on the table—or worse, never get to exit on their terms at all.

Succession planning isn’t something you should put off until the last minute. It’s a living, evolving process that helps you:

- Grow the value of your business over time

- Minimize taxes and risk

- Prepare for unexpected events

- Align your personal financial goals with your business strategy

Want to Know If You’re Ready for Your Exit?

Take our 10-question Succession Readiness Quiz and find out how ready you truly are.

What Makes a Strong Exit Plan?

A good succession plan doesn’t just cover the “what-ifs.” It guides you in building a more valuable, more transferable business, starting now.

At Highland Trust Partners, we assess all aspects of your business, including tangible and intangible value. Then, we help you develop a custom succession roadmap based on your goals.

Your plan may include:

- Identifying the business owner's assets, priorities, and succession goals (e.g. passing the business to family, selling internally, or selling to a competitor/private equity)

- Business assessment and readiness assessments

- Developing a comprehensive financial and estate plan to support the owner's retirement vision

- Coordinating with attorneys, accountants, and other professionals to execute the succession plan

- Ongoing monitoring and adjustments as needed

- A vision for life after business

We break it down into manageable 90-day sprints, allowing you to keep running your business while we layout a plan for the next chapter.

Curious where your business stands today? Book a quick intro call. We’ll show you how to find out.

LET'S TALK

Who We Work With

We work with small to midsize business owners who want to exit with clarity, confidence, and control. Whether you’re ten years out or already considering a transition, it’s always a good time to have a plan in place.

Our clients include:

- Dental and medical practices

- Insurance and financial services firms

- HVAC and home services companies

- Funeral homes

- Family-run businesses

- Owners nearing retirement who rely on the business for income

If you’re asking “how do I exit my business?” or “how can I retire without selling for less than it’s worth?” — we can help.

Why Work With Highland Trust Partners?

We’re not just financial advisors, we’re business owners who have been through this journey ourselves. We understand how much is riding on your decisions and how overwhelming the exit process can feel. Our role is to help you slow down, zoom out, and plan with intention.

- Fee-based advice: You get honest, objective guidance, no sales pitches

- Collaborative support: We’ll work alongside your attorney, CPA, and other trusted advisors.

- Real conversations: We meet you where you’re at. No jargon, no pressure.

We’re based in Athens, Georgia, and serve business owners across the Peach State and beyond. If you’re ready to get organized, get answers, and get serious about your future, we’d love to talk.

Start with a 30-minute consultation. Let’s find out what your business is worth and what it will take to exit on your terms.

Frequently Asked Questions

When should I start succession planning?

Ideally, you should start succession planning as early as possible, even in the first few years of running your business. The earlier you plan, the more options you’ll have and the more value you can build.

How do I know what my business is worth?

We use valuation tools like BizEquity and Maus to give you a realistic picture of your business’s current value, including both tangible and intangible assets.

What happens if I don’t have a plan?

We all know how unpredictable the future can be. Without a plan, your exit may be rushed or forced, leading to lower sale value, higher taxes, or even business closure. Succession planning helps protect you, your family, your employees, and your legacy.

Can I sell my business and still receive income from it?

Yes, there are ways to structure your exit so you continue receiving income. This depends on your goals, the buyer, and your financial plan. We’ll help you explore your options.

What’s included in your 30-minute consultation?

We’ll talk about your goals, your business, and where you are in the planning process. You’ll walk away with clarity on next steps, and whether a formal plan makes sense right now.