The start of a new year brings a sense of order. You may feel ready to reset routines, revisit habits, and create a clear path for the months ahead. Your financial life deserves the same attention. Setting financial goals gives you direction and helps you stay focused on what matters most to you.

If you want the year to feel more intentional, a simple process can help you create goals that fit your life today and the future you want to build.

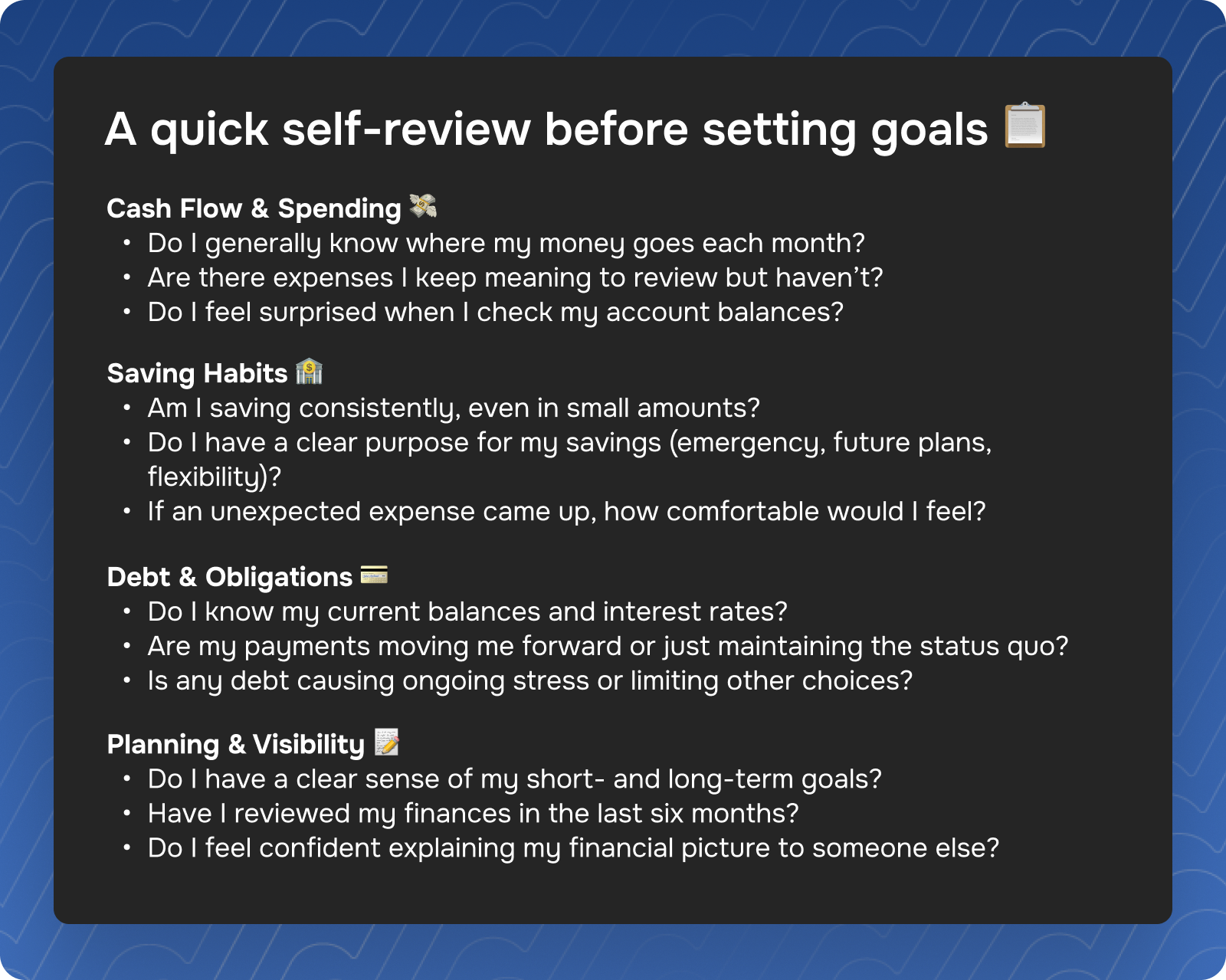

Before setting new goals, take a moment to look at your current situation. This is similar to the way many planning conversations begin. You gather the facts, look at what is working, and note what needs attention.

Review your income, spending, savings habits, and debt. You do not need a complicated spreadsheet. A few clear numbers can give you a strong starting point.

Ask yourself a few questions as you look things over.

Are you spending more than you mean to?

Are you saving often enough?

Do certain expenses keep climbing?

This honest look helps you see where new goals can create the most impact.

Once you understand where things stand, shift toward what you want the year to look like. Financial goals are most useful when they reflect your real life. A goal that matters to you tends to be easier to stick with.

Think about the areas of your financial life you want to strengthen. Some people want to build an emergency fund. Others want to reduce debt or increase retirement savings. Some may plan for a move, a major purchase, or new family needs. Each situation is different, and your goals should reflect your own priorities.

Ask yourself: What would bring more stability or clarity to my financial life this year?

Your answer will point you toward the goals that deserve your attention.

Large goals feel easier when they are broken down into smaller tasks. You give yourself stepping stones instead of a long, uncertain path.

Here is a simple way to do that with one section of bullets for clarity:

• Choose one financial area to focus on first

• Write down the specific action you plan to take

• Decide how often you will take that action

• Note how you will measure progress

For example, if your goal is to build savings, your steps may include setting aside a set amount from each paycheck or reviewing monthly spending to free up more room to save. If your goal is to pay down debt, your steps may include prioritizing one balance and setting a payment amount that fits your cash flow.

Small actions done consistently tend to move you forward.

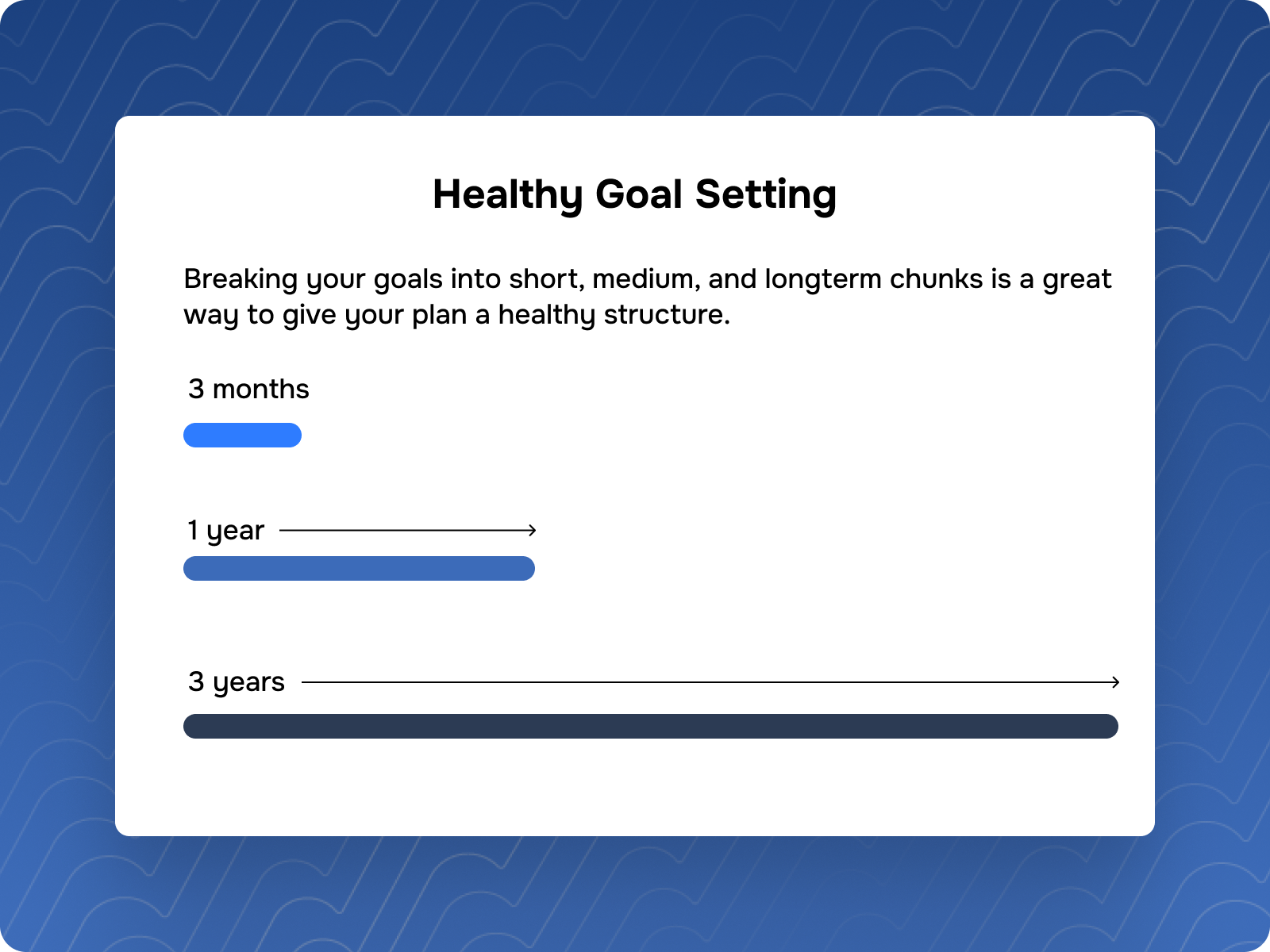

Timeframes help you stay on track. They also help you see which goals fit into the next few months and which goals may take longer.

Short-term goals may include building a small cash reserve or planning for upcoming expenses. Mid-term goals may involve reducing debt or increasing savings. Long-term goals often include retirement planning or preparing for future family needs.

Pick timeframes that match your reality. A goal with a reasonable timeline encourages steady progress. A timeline that feels too tight often creates unnecessary pressure.

If you want guidance, think about what you want to accomplish in the next 3 months, 12 months, and 3 years. This simple approach can bring structure to your plan.

Tracking your goals does not need to be complicated. You can use an app, a spreadsheet, or a calendar reminder. What matters is consistency.

A quick monthly review helps you see where things stand. You may find that you are spending less than you thought, saving more than expected, or drifting off course. Regular check-ins keep your plan grounded in your real financial life, not an ideal version of it.

This type of steady monitoring is a practice many advisors use when reviewing plans with clients. Small adjustments along the way keep goals from getting too far off track.

If you’re ready to review your finances, set up a quick introductory call with one of our advisors at Highland Trust Partners today.

Your goals should adapt as your life does. New jobs, family changes, rising expenses, or unexpected events can shift priorities. Flexibility helps you stay aligned with your needs rather than feeling tied to a plan that no longer fits.

Ask yourself: What changes this year might influence my goals?

You may not know the answer today, and that is fine. What matters is being open to reviewing and adjusting your goals when needed.

A good financial plan is not rigid. It evolves with you.

You can set financial goals on your own, but there are times when speaking with a financial planner can help bring clarity. A planner can review your full financial picture, help you align your goals with your resources, and create a structure for tracking progress. They can also help you prepare for moments you may not see coming.

If you want guidance or want to refine the goals you already have, working with a trusted financial advisor can give you confidence as you move into the year. Highland Trust Partners works with individuals and families in Athens, Georgia and throughout the United States, helping them create financial plans that reflect their values and priorities.

The best way to begin is to start small. Pick one goal that matters to you and write down the first step you plan to take. Once you build momentum, the rest becomes easier.

Setting financial goals is not about perfection. It is about direction. With a clear plan and steady habits, you give yourself a strong foundation for the year ahead.

More than 99% customer satisfaction is our success.